Welcome to the world of Medicare Supplement Plans in Virginia! If you’re feeling a bit bewildered by the various healthcare options available, fear not. In this guide, we’ll take a journey together to unravel the mysteries of Medicare Supplement Plans, also known as Medigap, in the charming state of Virginia. So, grab a cup of tea, sit back, and let’s dive into this fascinating topic!

What is Medicare and Why Do You Need Supplement Plans? Medicare is a federal health insurance program designed to provide coverage for individuals aged 65 and older. It also covers certain younger individuals with disabilities. While Medicare is a comprehensive plan, it doesn’t cover everything. That’s where Medicare Supplement Plans come into play.

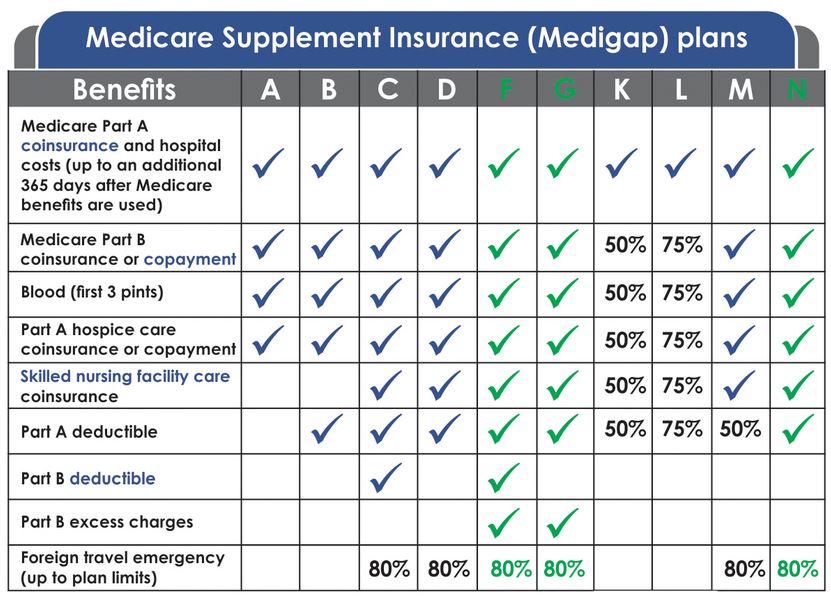

Understanding Medicare Supplement Plans (Medigap) Medicare Supplement Plans, often referred to as Medigap, are private health insurance policies that help fill the gaps left by Original Medicare (Parts A and B). These plans are offered by private insurance companies and are regulated by both federal and state laws. In Virginia, as in other states, there are ten standardized Medigap plans to choose from, labeled with letters from A to N.

Benefits of Medicare Supplement Plans One of the key benefits of Medicare Supplement Plans is the peace of mind they provide. These plans can help cover costs such as copayments, deductibles, and coinsurance that Original Medicare may not fully cover. They also offer the flexibility to see any doctor or specialist who accepts Medicare patients, without the need for referrals or network restrictions.

Comparing Medigap Plans in Virginia Each Medigap plan offers a different set of benefits, and it’s essential to choose one that aligns with your specific needs. Here’s a brief overview of the ten standardized Medigap plans available in Virginia:

- Plan A: This plan offers basic benefits, including coverage for hospital coinsurance and copayments under Medicare Part A, as well as coinsurance or copayments under Part B.

- Plan B: Similar to Plan A, but with the addition of coverage for Medicare Part A deductibles.

- Plan C: This plan covers all of the benefits of Plan A and adds coverage for skilled nursing facility care and Part B excess charges.

- Plan D: Similar to Plan C, but without coverage for Part B excess charges.

- Plan F: Offers the most comprehensive coverage, including coverage for all Part A and B deductibles, coinsurance, and excess charges.

- Plan G: Similar to Plan F, but without coverage for the Part B deductible.

- Plan K: Provides coverage for a percentage of Part A and B coinsurance and copayments, but with an out-of-pocket limit.

- Plan L: Similar to Plan K, but with a higher percentage of coverage and a lower out-of-pocket limit.

- Plan M: Covers half of the Part A deductible and offers limited coverage for foreign travel emergencies.

- Plan N: Offers coverage similar to Plan D, but with the addition of copayments for certain doctor visits and emergency room visits.

Enrollment and Eligibility To be eligible for a Medicare Supplement Plan in Virginia, you must be enrolled in Original Medicare (Parts A and B). The best time to enroll in a Medigap plan is during the six-month Medigap Open Enrollment Period, which starts on the first day of the month in which you turn 65 and are enrolled in Medicare Part B. During this period, insurance companies are required to offer you a policy without considering your health condition.

How to Choose the Right Medicare Supplement Plan in Virginia Choosing the right Medicare Supplement Plan in Virginia can be a bit overwhelming, but fear not! Here are a few factors to consider when making your decision:

- Assess your healthcare needs: Consider your current health status and anticipated medical expenses. Do you have specific healthcare needs or conditions that require coverage?

- Compare plan benefits and costs: Look at the benefits offered by each plan and compare them to your needs. Also, consider the monthly premium costs and any potential out-of-pocket expenses.

- Research insurance companies: Look for insurance companies that offer Medigap plans in Virginia and have a good reputation for customer service and claim handling.

- Seek advice: Don’t hesitate to reach out to a licensed insurance agent or counselor who can help guide you through the process and provide personalized recommendations based on your circumstances.

Congratulations! You’ve embarked on a journey to demystify the world of Medicare Supplement Plans in Virginia. Armed with this newfound knowledge, you’re now better equipped to make an informed decision about your healthcare coverage. Remember, understanding your options and assessing your needs are the keys to finding the perfect Medigap plan that provides the peace of mind you deserve. So, go forth and navigate the intricate web of healthcare with confidence!